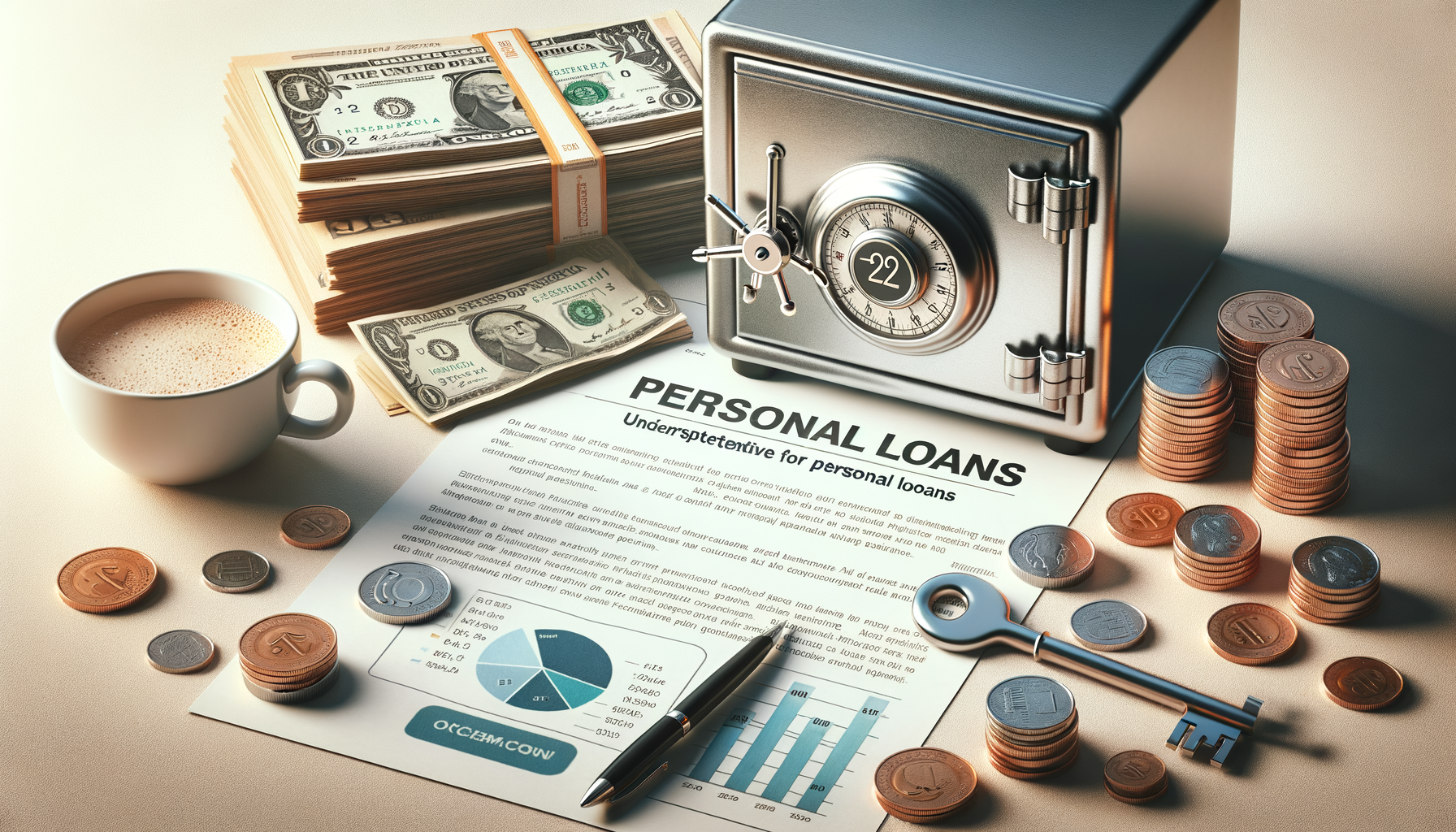

Understanding Personal Loans: A Comprehensive Guide

Introduction to Personal Loans

Personal loans have become a popular financial tool for individuals seeking to manage expenses, consolidate debt, or finance large purchases. Unlike secured loans, personal loans do not require collateral, making them accessible to a broader audience. This flexibility, combined with competitive interest rates, makes personal loans an attractive option for many. Understanding how personal loans work and their potential benefits can empower consumers to make informed financial decisions.

Personal loans are typically unsecured, meaning they do not require the borrower to pledge any assets as security. This aspect of personal loans can be particularly appealing to those who may not have significant assets to offer as collateral. Additionally, personal loans can be used for a variety of purposes, including:

- Debt consolidation

- Home improvements

- Medical expenses

- Major life events

With the financial landscape constantly evolving, personal loans provide a versatile solution for those needing immediate funds. By understanding the mechanics and advantages of personal loans, individuals can better navigate their financial journeys.

How Personal Loans Work

Personal loans operate on a simple principle: a lender provides a borrower with a specific amount of money, which is then repaid over a set period with interest. The terms of a personal loan, such as the interest rate and repayment period, are determined by the lender based on the borrower’s creditworthiness and financial history.

The process typically begins with the borrower submitting a loan application. The lender will then assess the application, considering factors such as credit score, income, and existing debt. If approved, the borrower receives the funds in a lump sum, which can be used as needed.

Repayment of personal loans is usually structured in fixed monthly installments, making it easier for borrowers to plan their budgets. Key features of personal loans include:

- Fixed or variable interest rates

- Flexible repayment terms

- Potential for lower interest rates compared to credit cards

Understanding these elements can help borrowers choose the right loan product to suit their financial needs.

Benefits of Personal Loans

Personal loans offer several advantages that make them a preferred choice for many borrowers. One significant benefit is the ability to consolidate high-interest debt into a single, more manageable payment. This can lead to substantial savings on interest payments over time.

Another advantage is the flexibility in use. Unlike some loans that are earmarked for specific purposes, personal loans can be used for a wide range of needs, providing borrowers with the freedom to allocate funds as they see fit.

Additional benefits include:

- Quick access to funds

- No collateral required

- Potential to improve credit score through timely payments

These benefits make personal loans a versatile financial tool, suitable for addressing various financial challenges.

Potential Drawbacks of Personal Loans

While personal loans offer numerous benefits, they also come with potential drawbacks that borrowers should be aware of. One of the primary concerns is the interest rate, which can be higher for individuals with lower credit scores. This can lead to higher overall costs over the life of the loan.

Additionally, personal loans can sometimes lead to a cycle of debt if not managed properly. Borrowers should ensure they have a clear repayment plan in place to avoid financial strain. It’s also important to consider any fees associated with personal loans, such as origination fees or prepayment penalties.

Understanding these potential drawbacks can help borrowers make informed decisions and avoid common pitfalls associated with personal loans.

Conclusion: Making Informed Decisions

Personal loans can be a valuable financial tool when used responsibly. They offer flexibility, quick access to funds, and the potential to consolidate debt, making them an appealing option for many. However, it’s crucial for borrowers to fully understand the terms and conditions of any loan agreement and to assess their financial situation before proceeding.

By weighing the benefits and potential drawbacks, individuals can make informed decisions that align with their financial goals. As with any financial product, careful consideration and planning are key to maximizing the advantages of personal loans while minimizing risks.