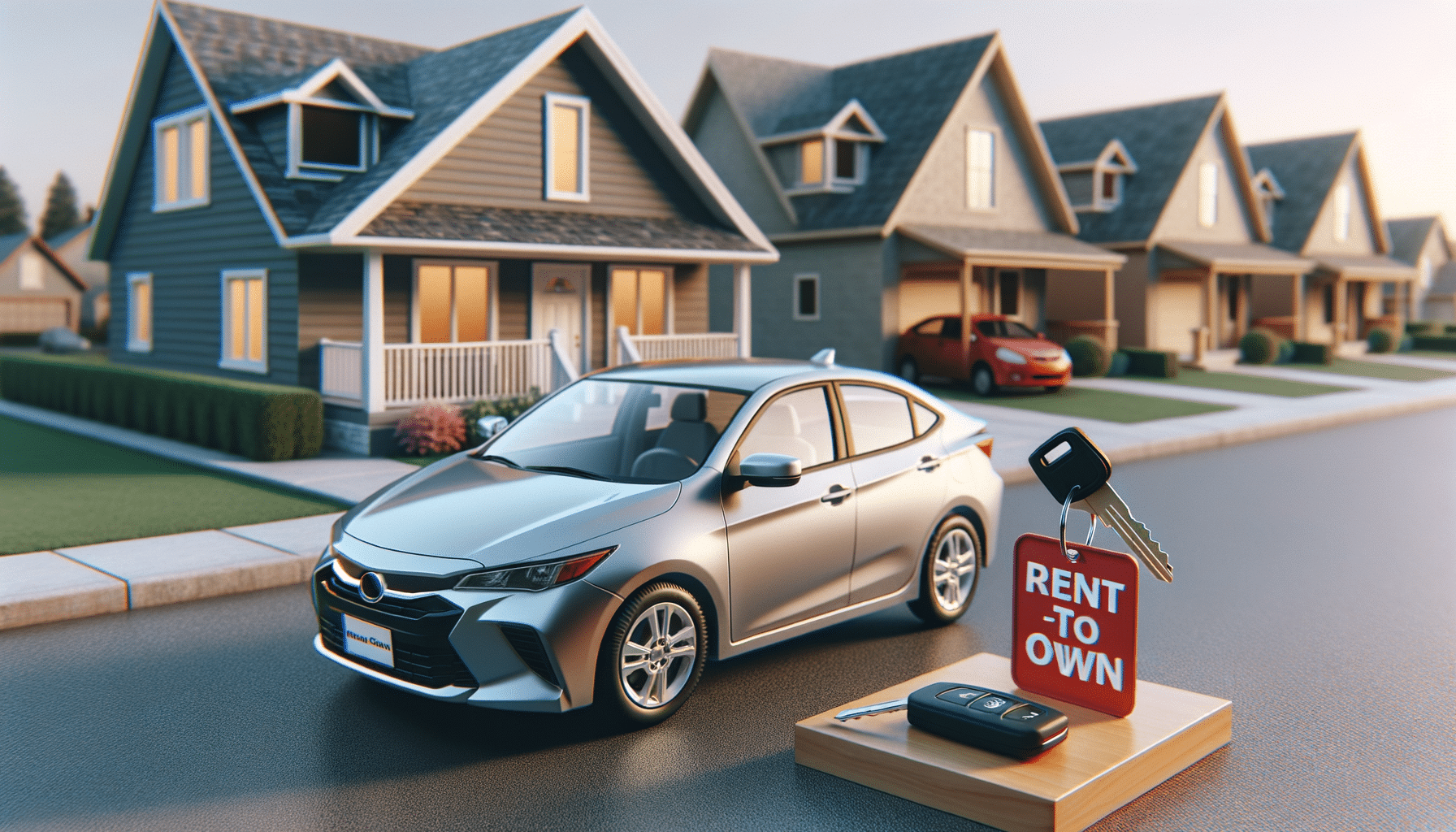

Explore affordable Rent-to-Own Car Options

Introduction to Rent-to-Own Car Options

In today’s fast-paced world, having access to a reliable vehicle is often essential. However, not everyone can afford to purchase a car outright or qualify for traditional financing. This is where rent-to-own car options come into play, offering an alternative route to vehicle ownership. These programs provide a unique opportunity for individuals to drive a car while making payments that eventually lead to ownership. This article delves into the various aspects of rent-to-own cars, highlighting their benefits, potential drawbacks, and key considerations for prospective buyers.

Understanding the Rent-to-Own Car Model

The rent-to-own car model is designed to cater to individuals who may face challenges in securing traditional auto loans. This arrangement allows consumers to rent a vehicle for a specified period, with a portion of their monthly payments contributing towards the eventual purchase of the car. Typically, these agreements span from one to three years, giving renters ample time to decide if they wish to complete the purchase.

One of the primary advantages of this model is the flexibility it offers. Renters can choose to walk away at the end of the rental period without any further obligations, making it an attractive option for those who are unsure about committing to a long-term purchase. Additionally, the rent-to-own model often does not require a perfect credit score, providing an accessible path to car ownership for individuals with less-than-ideal credit histories.

However, it’s crucial for potential renters to thoroughly understand the terms of their agreement. Some contracts may include higher interest rates or additional fees, which can increase the overall cost of the vehicle. Therefore, prospective customers should carefully review the contract details and consider their financial situation before entering into a rent-to-own agreement.

Benefits of Rent-to-Own Car Programs

Rent-to-own car programs offer several benefits that make them appealing to a wide range of consumers. One of the most significant advantages is the ability to drive a car without the need for a large down payment. This feature is particularly beneficial for individuals who may not have the savings required for a traditional car purchase.

Additionally, rent-to-own agreements often provide a pathway to improve one’s credit score. By making consistent, on-time payments, renters can demonstrate financial responsibility, which may positively impact their credit history over time. This can be a crucial step for individuals looking to rebuild their credit and improve their future borrowing prospects.

Another benefit is the opportunity to test drive the car for an extended period before committing to ownership. This allows renters to evaluate the vehicle’s performance and suitability for their needs, ensuring they make an informed decision. Furthermore, the flexibility to exit the agreement without purchasing the car provides peace of mind for those who may experience changes in their financial circumstances.

Potential Drawbacks and Considerations

While rent-to-own car programs offer numerous benefits, there are also potential drawbacks that consumers should be aware of. One of the primary concerns is the overall cost of the vehicle, which can be higher than purchasing outright due to interest rates and additional fees included in the agreement.

Renters should also be cautious of the condition and maintenance of the vehicle. Since rent-to-own cars are often used vehicles, it’s essential to conduct a thorough inspection and ensure the car is in good working order before signing any agreements. Additionally, renters should clarify who is responsible for maintenance and repairs during the rental period, as unexpected expenses can quickly add up.

Another consideration is the potential impact on one’s credit score if payments are not made on time. Late or missed payments can negatively affect credit history, undermining the benefits of the program. Therefore, it’s crucial for renters to assess their financial stability and ensure they can meet the payment obligations consistently.

Conclusion: Is Rent-to-Own Right for You?

Rent-to-own car programs present a viable option for individuals seeking an alternative path to vehicle ownership. With benefits such as flexible terms, the ability to improve credit scores, and the opportunity to test drive a car before buying, these programs can be an excellent choice for those facing financial constraints or credit challenges.

However, it’s essential to weigh the potential drawbacks, such as higher overall costs and the condition of the vehicle, before committing to a rent-to-own agreement. Prospective renters should thoroughly review contract terms, understand their financial responsibilities, and consider their long-term goals before deciding if this option aligns with their needs.

Ultimately, rent-to-own car programs can offer a practical solution for many, but careful consideration and informed decision-making are key to ensuring a positive experience.