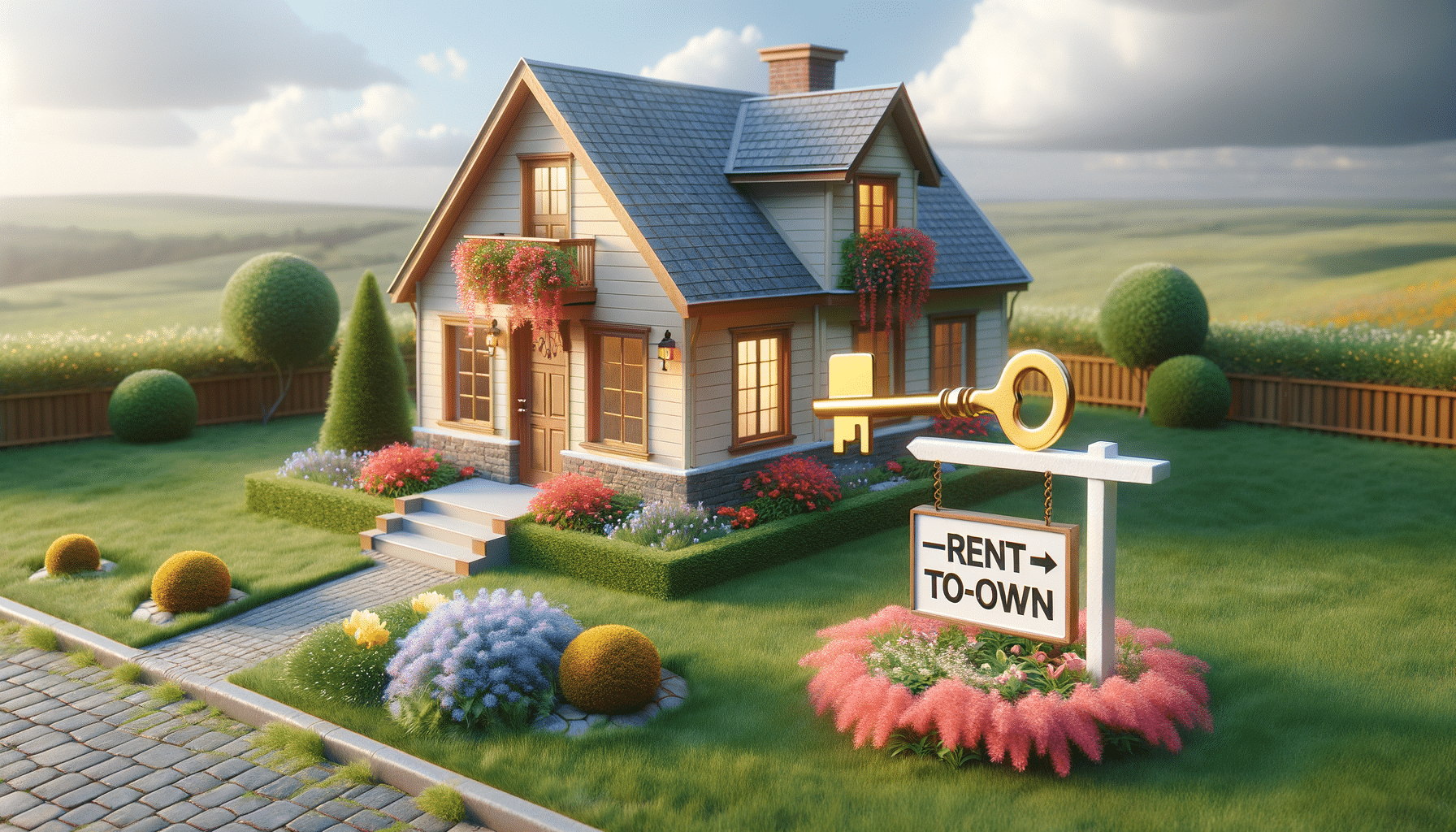

Understanding Rent-to-Own Homes

Introduction to Rent-to-Own Homes

In the ever-evolving real estate market, rent-to-own homes have emerged as a viable alternative for individuals aspiring to own a home but facing financial constraints. This innovative approach allows potential homeowners to rent a property with the option to purchase it at a later date. Rent-to-own agreements can be particularly beneficial for those who need time to improve their credit scores or save for a down payment. By understanding the intricacies of these agreements, prospective buyers can make informed decisions that align with their financial goals.

How Rent-to-Own Agreements Work

A rent-to-own agreement typically consists of two components: a standard lease agreement and an option to purchase. During the lease period, tenants pay rent, a portion of which may be credited towards the eventual purchase of the home. The option to purchase gives the tenant the right, but not the obligation, to buy the property at a predetermined price after the lease term.

Key elements of a rent-to-own agreement include:

- Option Fee: An upfront fee paid by the tenant to secure the option to purchase the property. This fee is usually non-refundable but may be applied to the purchase price.

- Purchase Price: The agreed-upon price at which the tenant can buy the home. This price is often set at the beginning of the lease period.

- Lease Term: The duration of the rental period, typically ranging from one to three years.

- Rent Credit: A portion of the monthly rent payment that is credited towards the purchase price.

Understanding these components is crucial for tenants to assess whether a rent-to-own agreement aligns with their homeownership goals.

Benefits of Rent-to-Own Homes

Rent-to-own homes offer several advantages for individuals who are not yet ready to commit to a traditional mortgage. One significant benefit is the ability to lock in a purchase price, protecting tenants from potential market fluctuations. This can be especially advantageous in rising real estate markets where home prices are expected to increase.

Additionally, rent-to-own agreements provide tenants with the opportunity to build equity over time. As a portion of the rent is credited towards the purchase price, tenants effectively accumulate savings that can be applied to the home’s cost. This arrangement can also serve as a trial period, allowing tenants to experience living in the home and neighborhood before making a long-term commitment.

Furthermore, rent-to-own agreements can be a pathway to homeownership for those with less-than-perfect credit. By demonstrating consistent, on-time rent payments, tenants can improve their credit scores, potentially qualifying for better mortgage terms in the future.

Potential Drawbacks and Considerations

While rent-to-own homes offer numerous benefits, they also come with potential drawbacks that prospective buyers should consider. One of the primary concerns is the risk of losing the option fee and any rent credits if the tenant decides not to purchase the home or is unable to secure financing at the end of the lease term.

Additionally, tenants are often responsible for maintenance and repairs during the lease period, which can be a financial burden. It is crucial for tenants to thoroughly inspect the property and negotiate terms that clearly outline maintenance responsibilities.

Another consideration is the possibility of market changes. If property values decline, tenants may find themselves locked into a purchase price higher than the current market value, potentially resulting in a financial loss.

Prospective buyers should carefully evaluate their financial situation and future plans before entering into a rent-to-own agreement, ensuring it aligns with their long-term goals.

Conclusion: Is Rent-to-Own Right for You?

Rent-to-own homes provide a unique opportunity for individuals seeking an alternative path to homeownership. By offering the flexibility to rent while securing the option to buy, these agreements can be a strategic choice for those in transitional financial situations.

However, it is essential for potential buyers to conduct thorough research and seek professional advice to understand the terms and conditions of the agreement fully. Evaluating the benefits and drawbacks, as well as considering personal financial goals, will help determine if a rent-to-own arrangement is the right fit.

Ultimately, rent-to-own homes can be a stepping stone towards achieving the dream of homeownership, offering a tailored solution for those ready to take the first step on their journey.